To learn more about the McKinsey Quarterly, please click here.

* * *

A data-driven look at the link between the strategic moves of new CEOs and the performance of their companies highlights the importance of quick action and of adopting an outsider’s perspective.

The success of CEOs is deeply linked to the success of the companies they lead, but the vast body of popular literature on the topic explores this relationship largely in qualitative terms. The dangers of these approaches are well known: it’s easy to be misled by outliers or to conclude, mistakenly, that prominent actions which seem correlated with success were responsible for it.

We tried to sidestep some of these difficulties by systematically reviewing the major strategic moves (from management reshuffles to cost-reduction efforts to new-business launches to geographic expansion) that nearly 600 CEOs made during their first two years in office. Using annualized total returns to shareholders (TRS), we assessed their companies’ performance over the CEOs’ tenure in office. Finally, we analyzed how the moves they made—at least those visible to external observers1 —and the health of their companies when they joined them influenced the performance of those companies.2

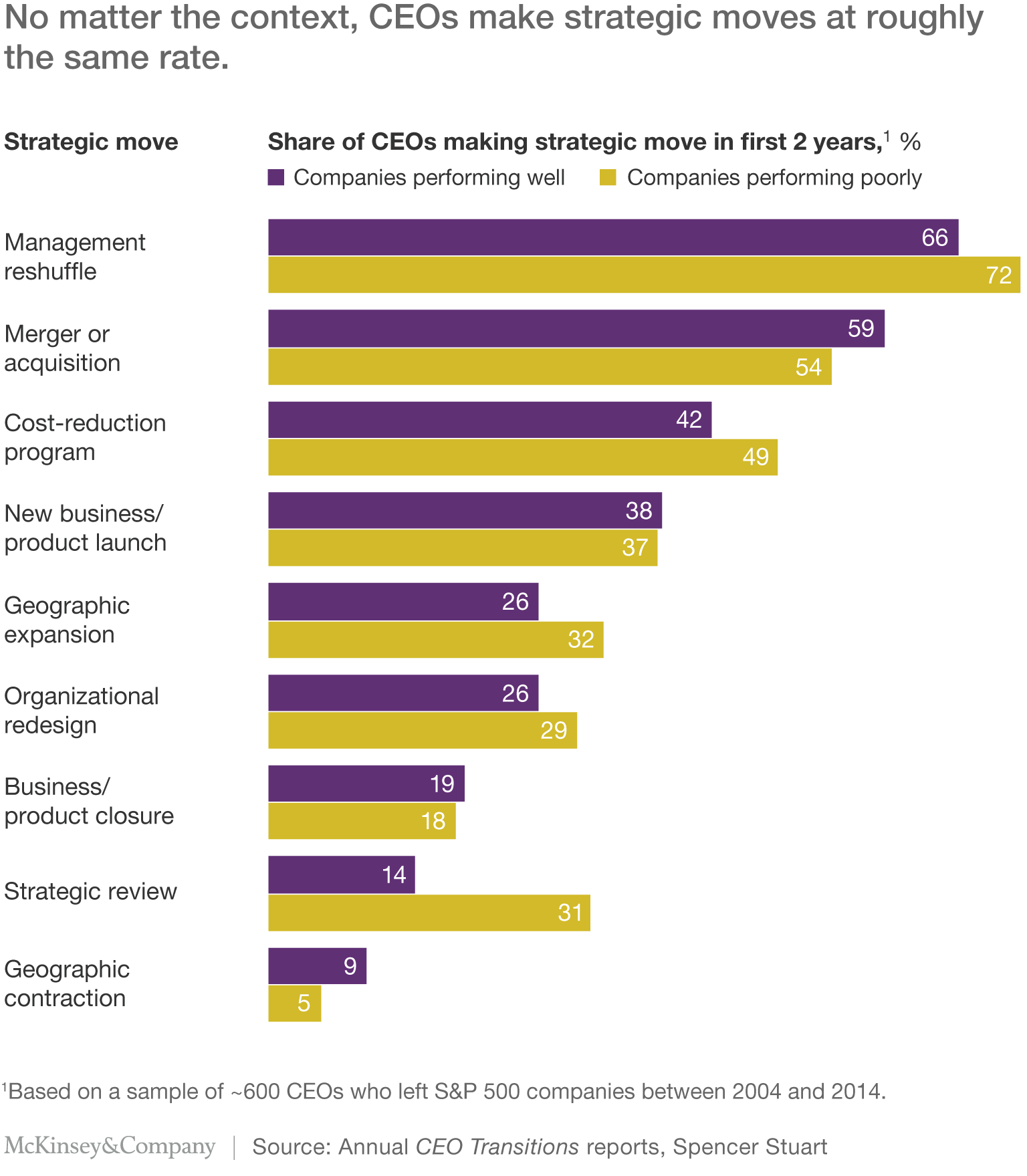

The results of this analysis, bolstered by nearly 250 case studies, show that the number and nature of the strategic moves made by CEOs who join well- and poorly performing companies are surprisingly similar. The efficacy of certain moves appears to vary significantly across different groups of companies, however. What’s more, the sheer number of moves seems to make a difference, at least for CEOs who join poorly performing companies. Also, external hires appear to have a greater propensity to act.

These findings have important practical implications for new CEOs and the boards that hire them: focus early on a few bold moves well suited to the context of your company, and recognize the value of the outsider’s perspective—whether or not you are one.

[Here is the first of the practical implications.]

Surprising similarities

The starting point for our analysis was a group of nearly 600 CEOs who left S&P 500 companies from 2004 to 2014 (identified in the annual CEO Transitions report produced by Spencer Stuart, the global executive-search and leadership-consulting firm).3 For each CEO’s first two years, we gathered information—from a range of sources, including company reports, investor presentations, press searches, and McKinsey knowledge assets—on nine strategic moves that chief executives commonly make.

We expected that CEOs taking the helm at poorly performing companies, feeling compelled to do something to improve results, would have a greater propensity to make strategic moves than those who joined well-performing organizations. To learn whether this idea was true, we looked at how each company had been performing relative to its industry counterparts prior to the new CEO’s arrival and then subdivided the results into three categories: well-performing, poorly performing, and stable companies.4 When we reviewed the moves by companies in each of these categories, we found that new CEOs act in similar ways, with a similar frequency, whether they had joined well- or poorly performing organizations. CEOs in different contexts made bold moves—such as M&A, changing the management team, and launching new businesses and products—at roughly the same rate (Exhibit 1).

* * *

Here is a direct link to the complete article.

Michael Birshan is a principal in McKinsey’s London office, where Thomas Meakin is an associate principal; Kurt Strovink is a director in the New York office.

The authors wish to acknowledge the contributions of Joshua Fidler-Brown, Carolyn Dewar, Martin Hirt, Robbie Marwick, Devesh Mittal, Annabel Morgan, Blair Warner, and Owain Williams to the development of this article.